Banking so simple, you'll say "Now that was easy."

Life is complicated enough. At Afena Federal Credit Union, we believe money management should be as simple as A-B-C. We also know when it comes to spending your money, you want a checking account that meets your unique needs.

Want to earn high dividends on your money? We have an account for that! Simple and frill-free more your style? We have an account for that too. Trouble with checking accounts in the past and you need a second chance? We can do that too. And, all of our accounts can be accessed by online and mobile banking so you can manage your money anytime and anywhere.

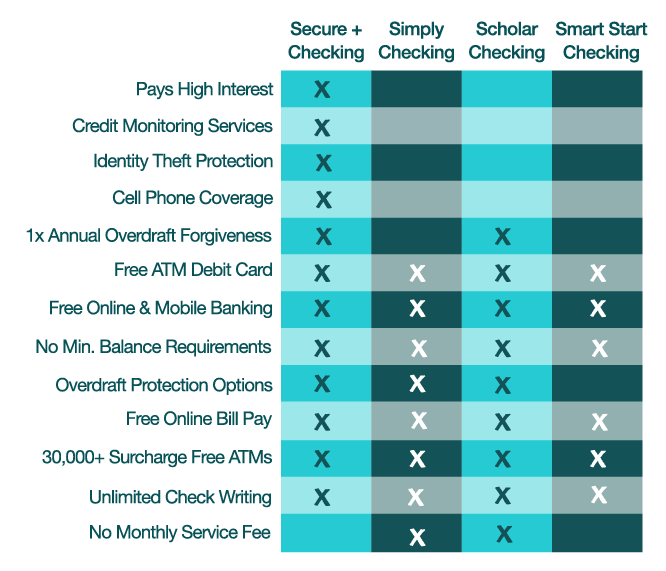

Ready to get started? Check out our four checking accounts and choose the one that works best for you.

Secure Plus Checking

Secure Plus Checking is a high dividend account that earns money while protecting your identity! You'll earn a 2.25% dividend rate on balances up to $10,000 and 0.50% on balances $10,000.01 and above OR earn a dividend rate of 0.05% based on how you use your account.1

- Earn dividends on deposits

- Identity theft protection

- Cell phone protection

- Credit monitoring

- Overdraft protection

- Free debit card*

- Free electronic bill pay

- Free digital banking

- Unlimited use of Afena ATMs

- 5 free non-Afena ATM transactions per month**

- Unlimited check-writing

- One-time annual overdraft forgiveness

- Low fee of $5.95 per month

It's so easy to qualify for the high dividend rate, you may already be doing it!

- Use your debit card at least 12 times each month

- Complete at least one automatic payment (ACH) or one bill pay transaction each month

- Be enrolled in and agree to receive eStatements each month

- Be enrolled in and log into online banking at least once each month

If you don't meet all of these qualifications, you'll still earn our base dividend rate of 0.05% and have an opportunity to earn the higher rate the next month!

Simply Checking

The name says it all with Simply Checking. No monthly fees, no minimum balances, everything you need, and nothing you don't.

- Totally free account

- No minimum balance

- Free debit card*

- Free electronic bill pay

- Unlimited use of Afena ATMs

- 5 free non-Afena ATM transactions per month**

- Free digital banking

- Overdraft protection options

- Unlimited check-writing

Smart Start Checking

If the mistakes of your past have kept you from getting a checking account at other financial institutions, Afena's Smart Start Checking account is the perfect account to get back on the track to financial health.

- For individuals who have had previous financial challenges

- Low $5 monthly fee

- Unlimited check writing

- Unlimited use of Afena ATMs

- 5 free non-Afena ATM transactions per month**

- Free debit card*

- Free digital banking

Scholar Checking

Students have different needs, like access to your money no matter where your education takes you. We get it. If you're a student with a valid student ID, our Scholar Checking account is for you!

- For young people ages 13 through college who are enrolled in academic programs

- No monthly fee

- No minimum balance

- Free debit card

- Unlimited use of 30,000 surcharge-free ATMs nationwide**

- Online and mobile banking

- One-time overdraft forgiveness per year

Afena Federal Credit Union is a full-service financial institution headquartered in Marion, IN that serves Grant, Wabash, Blackford, Jay, and Wells counties.

*Subject to approval

**Must have direct deposit; other institutions may impose their own surcharges

1 Qualification Information: Account transactions and activities may take one or more days to post and settle to the account and all must do so during the month in order to qualify for the account’s high dividend rate. The following activities do not count toward earning qualification requirements and/or qualifying you for the higher interest rate: ATM-processed transactions, transfers between accounts, debit card purchases processed by merchants and received by our credit union as ATM transactions, non-retail payment transactions and purchases made with debit cards not issued by our credit union. “Monthly Eligibility” means a period beginning on the first day of the current statement cycle through the close of the current statement cycle. Dividend Information: When your Secure Plus account qualifications are met during a month, the following dividends will be distributed to your account on the last day of the current statement cycle: Balances up to $10,000.00 receive a non-compounding APY* of 2.25%; and balances over $10,000.00 earn 0.50% interest rate on the portion of balance over $10,000.00, resulting in a non-compounding range from 2.25% to 0.57% APY* depending on the account’s balance. When Secure Plus qualifications are not met all balances in your Secure Plus account earn a non-compounding APY of 0.05%. APY = Annual Percentage Yield. Rates are variable and may change after account is opened. Fees may reduce earnings. Additional Information: Account approval, conditions, qualifications, limits, timeframes, enrollments, log-ons and other requirements apply. No minimum deposit is required to open the account. Monthly enrollment in online banking, receipt of electronic statements, 12 qualifying debit card post and settled transactions and one qualifying ACH or Afena bill payment post and settled transaction are conditions of the Secure Plus account. Enrollment in electronic services (e.g. online banking, electronic statements) and log-ons are required to meet some of the account’s qualifications. Limit 1 account per social security number. There is a recurring $5.95 monthly service charge. There are no fees to open or close this account. Contact one of our credit union service representatives for additional information, details, restrictions, processing limitations and enrollment instructions. Afena is federally insured by the NCUA.

It's time to get in control of your debt!

Take charge of your finances with a debt consolidation loan from Afena.